Payroll

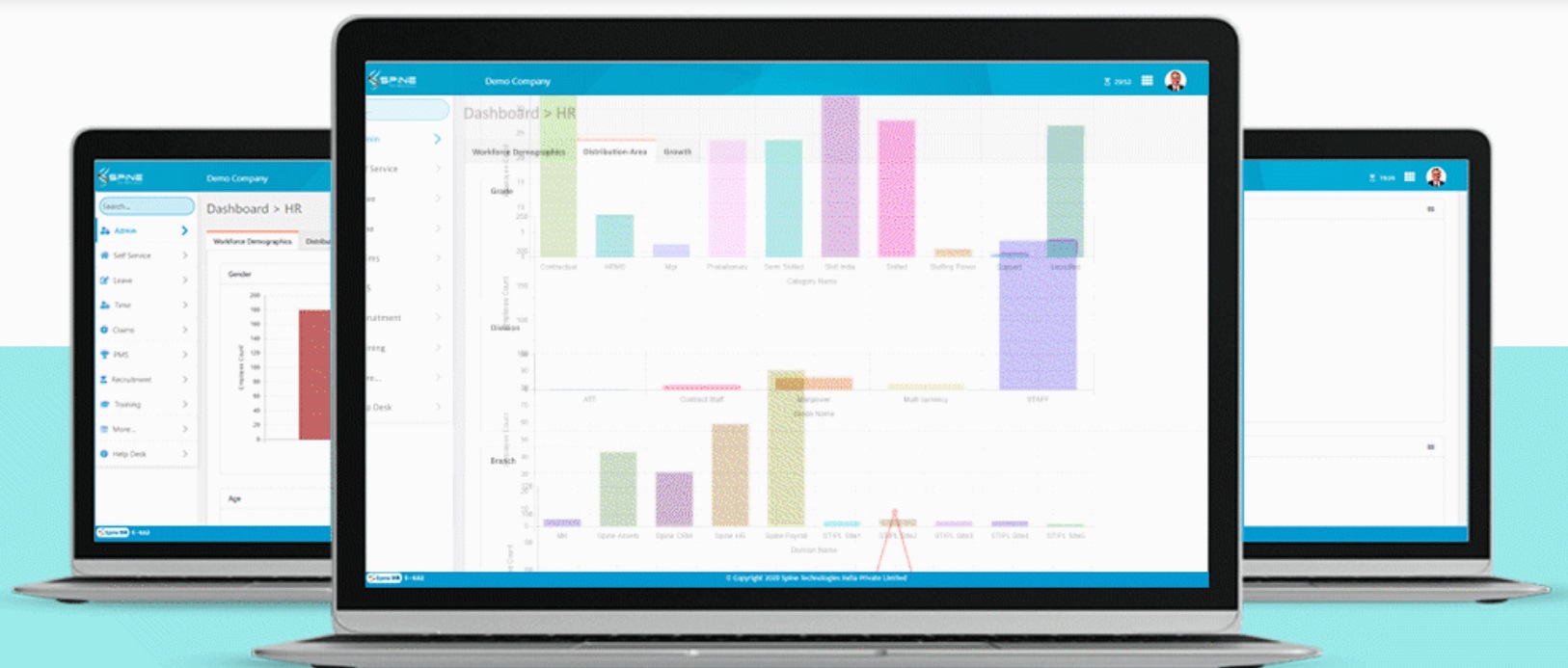

A comprehensive payroll system should encompass a wide range of features to efficiently manage employee compensation and related processes. These features should include demographics of employees, a structured employee database, and seamless integration with statutory compliances such as PF, ESIC, TDS, and eChallans. Additionally, leave management and customizable pay structures should be integral components to cater to diverse organizational needs.